KYC Entity Enrichment

From initial onboarding for a new business account, through to the periodic review of that entity thereafter, all banks have challenges around validating new customer data, resolving the information, and maintaining that data over time.

Onboarding a new fund slowly can mean you get less trading allocation than your competitors. In the Private Wealth world, a frustrated customer may just walk down the street to your competitor if the process for account opening or to obtain new products is slow.

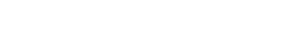

Using Arachnys’ APIs, this friction of onboarding can be lowered, and both initial KYC onboarding and ongoing refresh processes can be automated more easily using straight-through processing and automatic data resolution and decisioning.

How it works

Federate 23,000 data sources in 200+ jurisdictions

to resolve customers and counterparties.

Supercharge existing KYC and AML processes by

plugging them into intelligent data.

Entity resolution accuracy exceeds human capability

by drawing on signals hidden deep within datasets to

provide full automation even for incomplete or inaccurate input data.

Automated entity resolution and updates across

multiple datasets gives a real-time risk picture

of your customer base and counterparties.

Flexible API to integrate enriched data with your

ecosystem to identify hidden relationships or

enrich existing datasets.

Operating Model

For more information on the Arachnys APIs, visit our Developer Resources.