Intelligent data for correspondent banking and payments AML

AML is hard at the best of times. When you are facilitating transactions on behalf of third-parties, it’s even harder. With no KYC context to draw on, and often poor-quality input data, numbers of investigations can overwhelm the best teams.

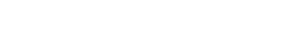

Arachnys’ intelligent data allows you to automatically enrich and validate even poor quality input information – gleaned from SWIFT messages or bulk remittance files – with no manual intervention.

Because data enrichment is totally automated, you can eliminate manual work by straight-through processing cases that don’t raise red flags.

Automated data also allows you to create better management information to oversee your partners themselves better and challenge network participants on the quality of their KYC and AML processes.

How it works

Federate 23,000 data sources in 200+ jurisdictions

to resolve customers and counterparties.

Supercharge existing KYC and AML processes by

plugging them into intelligent data.

Probabilistic, tunable matching suitable for both

perpetual KYC and AML alerting use cases.

Entity resolution accuracy exceeds human capability

by drawing on signals hidden deep within datasets to

provide full automation even for incomplete or inaccurate input data.

Automated entity resolution and updates across

multiple datasets gives a real-time risk picture

of your customer base and counterparties.

Integrate enriched data with CLM, network analysis

and visualization tools to identify hidden relationships

or enrich existing datasets of transactions or relationships.

Operating Model

For more information on the Arachnys APIs, visit our Developer Resources.