4 min read

The Empire Strikes Back! AML and the US CBP Forced Labor Process

![]() AML RightSource

:

April 26, 2021

AML RightSource

:

April 26, 2021

Star Wars fans will be familiar with the title of Episode V of the epic space franchise; in modern day reality, the “Empire” (in this case, in the form of the United States Customs & Border Protection – US CBP) agency has, in 2020 and 2021, taken significant action against allegations of Forced Labor under Section 307 of the Tariff Act of 1930 (19 U.S.C. § 1307) which prohibits the importation of merchandise mined, produced or manufactured, wholly or in part, in any foreign country by forced or indentured labor – including forced child labor – into the United States of America. Such merchandise is subject to exclusion and/or seizure, and may lead to criminal investigation of the importer(s).

As will be explained in this article, compliance officers from financial institutions should be aware of, and manage the risk on, those geographies, industries, or products companies subject to Withhold Release Orders and Findings, as part of their Anti Money Laundering (AML)/Countering Terrorist Financing (CFT) programme.

A financial institution handling funds associated with the import of goods subject to the US CBP Withhold Release Orders may be in violation of US laws, including AML/CFT legislation.

Financial institutions that are engaging with the originator (manufacturer or supplier) of the foreign goods subject to the Withhold Release Order may be at risk of handling the proceeds from forced labor (human trafficking), a predicate AML/CFT offence, as per the Financial Action Task Force (FATF) designated categories of offence.

Forced Labor (Human Trafficking) and AML/CFT

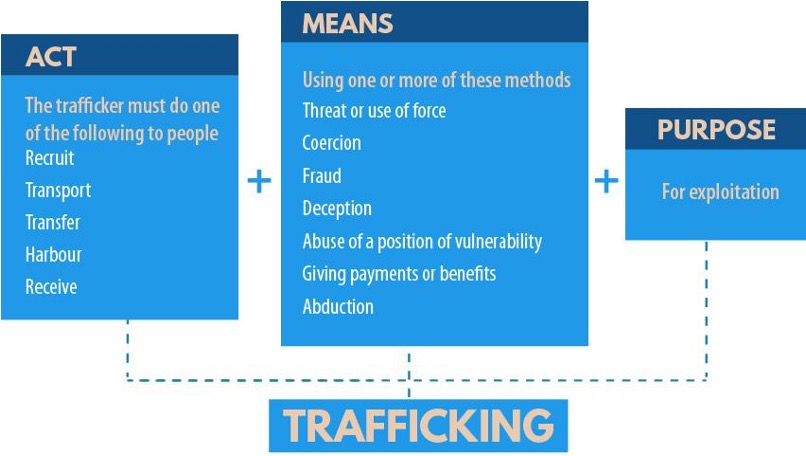

As highlighted above, “Trafficking in Persons and Smuggling of Migrants”, are designated categories of offence by the FATF and therefore widely inculcated into national AML/CFT laws in most jurisdictions.

The Protocol to Prevent, Suppress and Punish Trafficking in Persons, especially Women and Children (Palermo Protocol), part of the United Nations Convention against Transnational Organized Crime (UNTOC), provides a definition of Human Trafficking.

In its landmark report “Profits and Poverty: The Economics of Forced Labour” (2014), the International Labour Organization (ILO) outlined three areas of exploitation from human trafficking, the world’s 3rd or 4th largest criminal activity (by revenue) generating an estimated USD$150 billion a year, namely:

- sexual exploitation – estimated to account for 22% of victims of forced labor

- labor exploitation – estimated to account for 68% of victims of forced labor

- state imposed – estimated to account for 10% of forced labor

Whilst the numbers of victims are now estimated to be much higher, the proportion of victims trapped in each type of exploitation is estimated to be roughly the same. Most government focus & activity has been on victims trapped in sexual exploitation, and more recently on victims of forced labor in various sectors (fishing, construction, agriculture, domestic service).

The ILO has outlined 11 indicators of forced labor, intended to help “front-line” criminal law enforcement officials, labor inspectors, trade union officers, NGO workers and others to identify persons who are possibly trapped in a forced labor situation; these indicators represent the most common signs or “clues” that point to the possible existence of a forced labor case.

United Nations Security Council (UNSC) resolution 2331 (2016) brought the focus of the FATF, and members states, onto the financing of human trafficking; the FATF produced a follow-up analysis of the financial flows from human trafficking in 2018. This firmly entrenched that financial investigation and financial surveillance are key areas in identifying and targeting the financial activity and profits from human trafficking.

US CBP Forced Labor Process and Withhold Release Order Registry

Reporting of allegations of forced labor can be made directly to any Port Director or the Commissioner of CBP (19 C.F.R. § 12.42) by any person who has reason to believe that merchandise produced by forced labor is being, or is likely to be, imported into the United States; the process is outlined in the CBP’s Forced Labor process map.

The CBP acts on information concerning specific manufacturers/exporters and specific merchandise, partnering with U.S. Immigration and Customs Enforcement and other participating U.S. government agencies to investigate forced labor allegations.

CBP encourages stakeholders (including financial institutions) in the trade community to closely examine their supply chains to ensure goods imported into the United States are not mined, produced or manufactured, wholly or in part, with prohibited forms of labor, i.e., slave, convict, indentured, forced or indentured child labor.

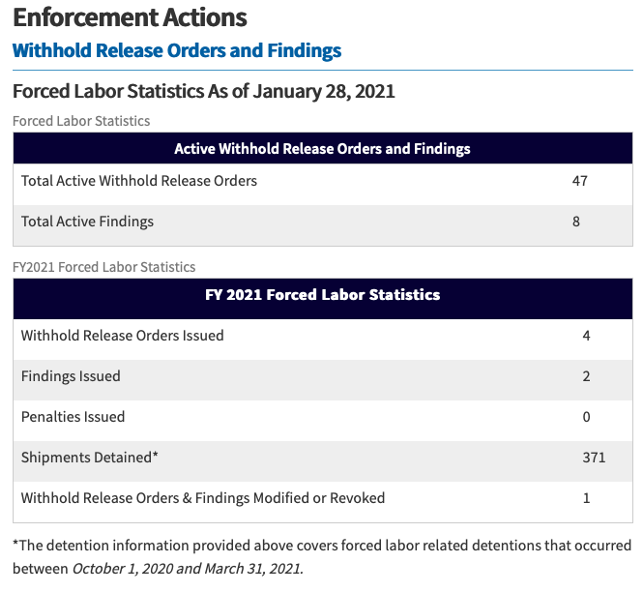

As at 28 January 2021 the CBP had taken these Enforcement Actions:

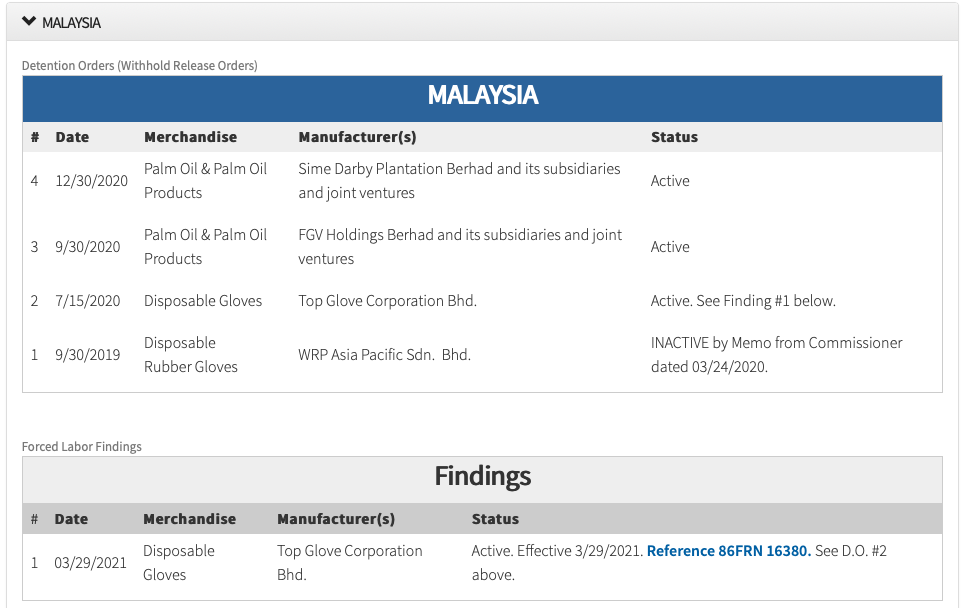

The registry is organised by country; as an example, several recent Withhold Orders have been made against Palm Oil producers from Malaysia, as outlined below.

Several of these allegations have garnered media attention, namely the designation of two major palm oil producers from Malaysia, a major exporter of palm oil, of which the US is major importer and user of palm oil. Financial institutions are also mentioned, for their involvement in handling the trade and proceeds from the trade. Financial crime experts say that in an industry rife with a history of problems, banks should flag arbitrary and inconsistent wage deductions as potential indicators of forced labor.

The designation of several palm oil producers has had a separate impact in that major clients have started to find alternate sources of supply.

What’s the risk for compliance professionals?

Financial Institution should, as part of their AML / CFT monitoring activities, check whether they have any associations with countries / industries / products / companies designated by the US CBP Withhold Orders, and these may be through several possible relationships:

- DIRECT – the financial institution is directly providing financial services to a named party

- INDIRECT – the financial institution is indirectly providing financial services to a named party i.e. via an intermediary company or entity

- CORRESPONDENT BANKING – the financial institution is in a correspondent banking relationship with a local financial institution that is directly providing financial services to a named party

- USD CLEARING – the financial institution is providing USD clearing services for financial institutions that are directly providing financial services to a named party

Financial institutions should continue to monitor the US CBP Withhold Orders registry for future updates and determinations.

The US CBP recommends that the trade community use the following resources to better understand and address the risks of forced labor in global supply chains: