2 min read

Onboarding commercial banking customers: automate to accelerate

![]() AML RightSource

:

October 19, 2020

AML RightSource

:

October 19, 2020

It’s a well known fact that, in banking, opening a new commercial account is not a fast or simple task. In fact, it’s a notoriously difficult and sometimes painful process which is dotted with friction points for the customer and the bank. However, when the various stages of onboarding are considered in detail, the opportunities for automation and ways to reduce onboarding times, costs and dependence on huge compliance teams become ever clearer.

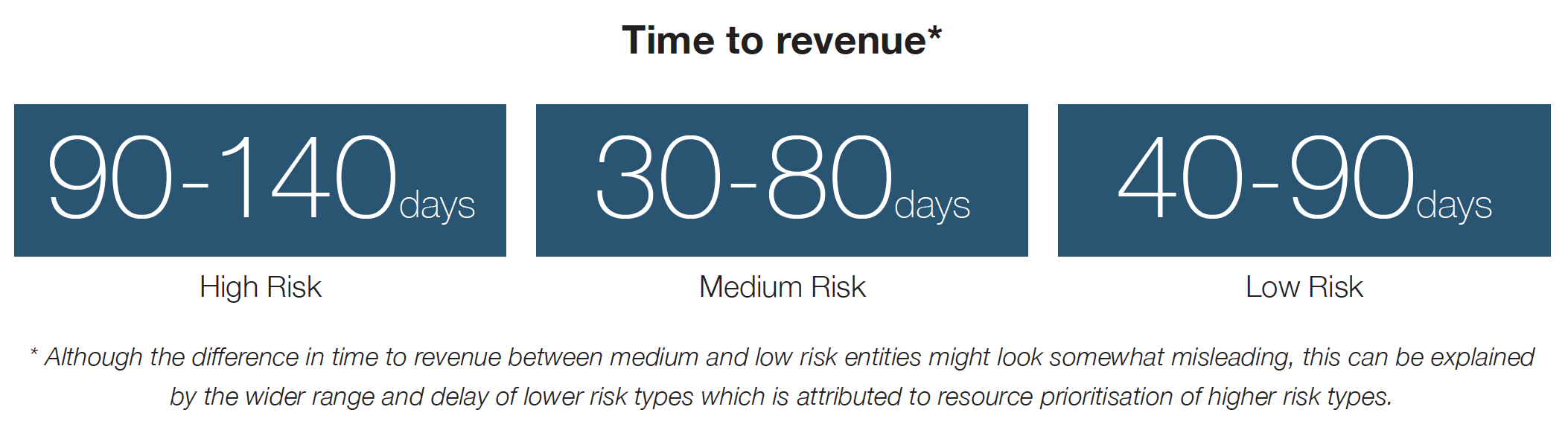

One of the starkest problems – and something regular readers of our blog will see us mention frequently – is the sheer amount of time it takes to complete onboarding or, from the bank’s perspective, “time to revenue”. Oliver Wyman’s Global KYC benchmarking study clearly highlights this:

Eight steps

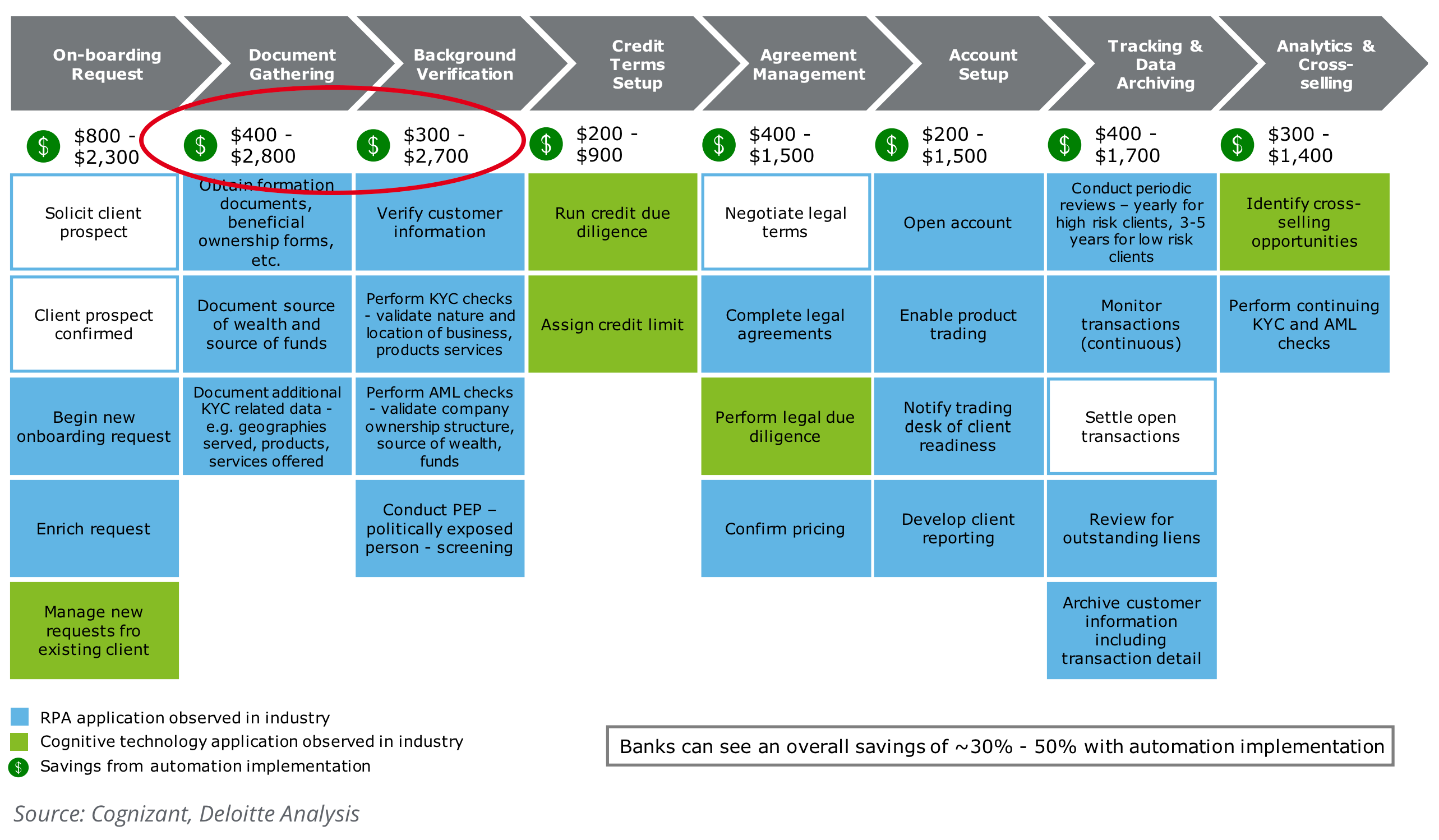

Onboarding commercial banking clients is typically made up of eight steps, and this goes some way to explain (but not necessarily justify) these lengthy timeframes. Note that a considerable fraction of the total time is eaten up at the start of the process, especially in the initial request, document gathering and background verification phases.

Source: Cognizant Data, Deloitte Analysis

By the end of this process, according to research from Deloitte, a bank will have spent as much as $20,000 – $30,000 to onboard a new client. This does not even take into consideration the ongoing monitoring or KYC refresh aspects which will now be part of the customer lifecycle process.

Automate to accelerate

Honing in on these early phases for a second, we should consider how they can potentially be accelerated to reduce friction. The document gathering process will typically follow traditional KYC procedures, with the bank requesting information on source of wealth, company structure, ultimate beneficial ownership (UBO) and so on.

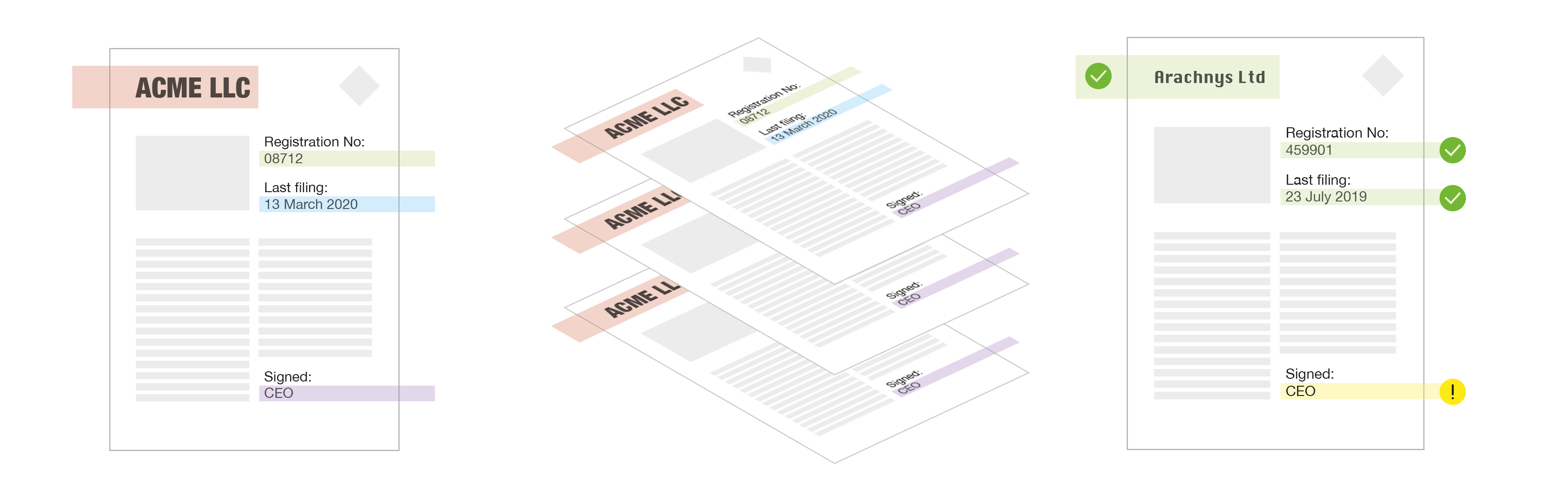

Robotic Process Automation (RPA) and machine learning can assist to accelerate processes involving paperwork. Machine learning can detect and learn from document patterns; for example, when KYC operatives scan for the same fields across many documents, such as registered business numbers and filing dates.

Browser-based extensions can assist KYC operatives by allowing them to add data wherever it is found, either from premium data providers (behind paywalls) or via scanned documents supplied by customers. This kind of automation all contributes to a more straight-through processing model.

Likewise, the background verification phase is lengthy. A bank will be required to perform various AML checks, screen the customer across sanctions, politically exposed persons (PEPs), adverse media and ultimately assign a risk rating to the new client. It is this area in particular, in conjunction with the document gathering, where erroneous, misleading or fraudulent information needs to be verified.

There are two areas where banks can utilize existing technology to improve this phase. Firstly, having access to global KYC and AML data which aggregates both premium and open-source data providers can help banks enrich and validate business entities. Secondly, leveraging RPA and machine learning to automate the manual and most laborious areas of the KYC process. Typically this now involves building an ecosystem which integrates services with a bank’s existing Customer Lifecycle Management (CLM) system, rather than building a layer cake of standalone platforms which are expensive and complex.

Further examples of utilizing RPA to speed up manual KYC processes include:

- Extracting information from unstructured data sources (e.g. financial statements)

- Automatically identifying UBOs and calculating shareholders

- Fuzzy matching common fields such as addresses

- Bulk screening for adverse media terms

- Merging/de-duplicating entities

Reducing costs

According to research from Deloitte, banks can expect a $400-$2,800 and $300-$2,700 saving per customer across the document gathering and background verification phases respectively, if they implement automation. Note that this also represents the largest cost saving in the whole onboarding process.

Through a combination of digitization and automation, banks can significantly increase onboarding for commercial clients, reducing both time and costs. The holy grail of automated KYC is moving to a purely exception or rules-based approach, where analysts are only alerted to deal with the information that needs scrutiny, and straight-through processes deal with the bulk of the work.

It is this same technology-based approach which will deliver consistent cost savings and a better customer experience for ongoing monitoring and perpetual KYC after the onboarding process.